🔀 One Canonical Schema

Normalize across aggregators and bank feeds into a stable contract your systems can rely on.

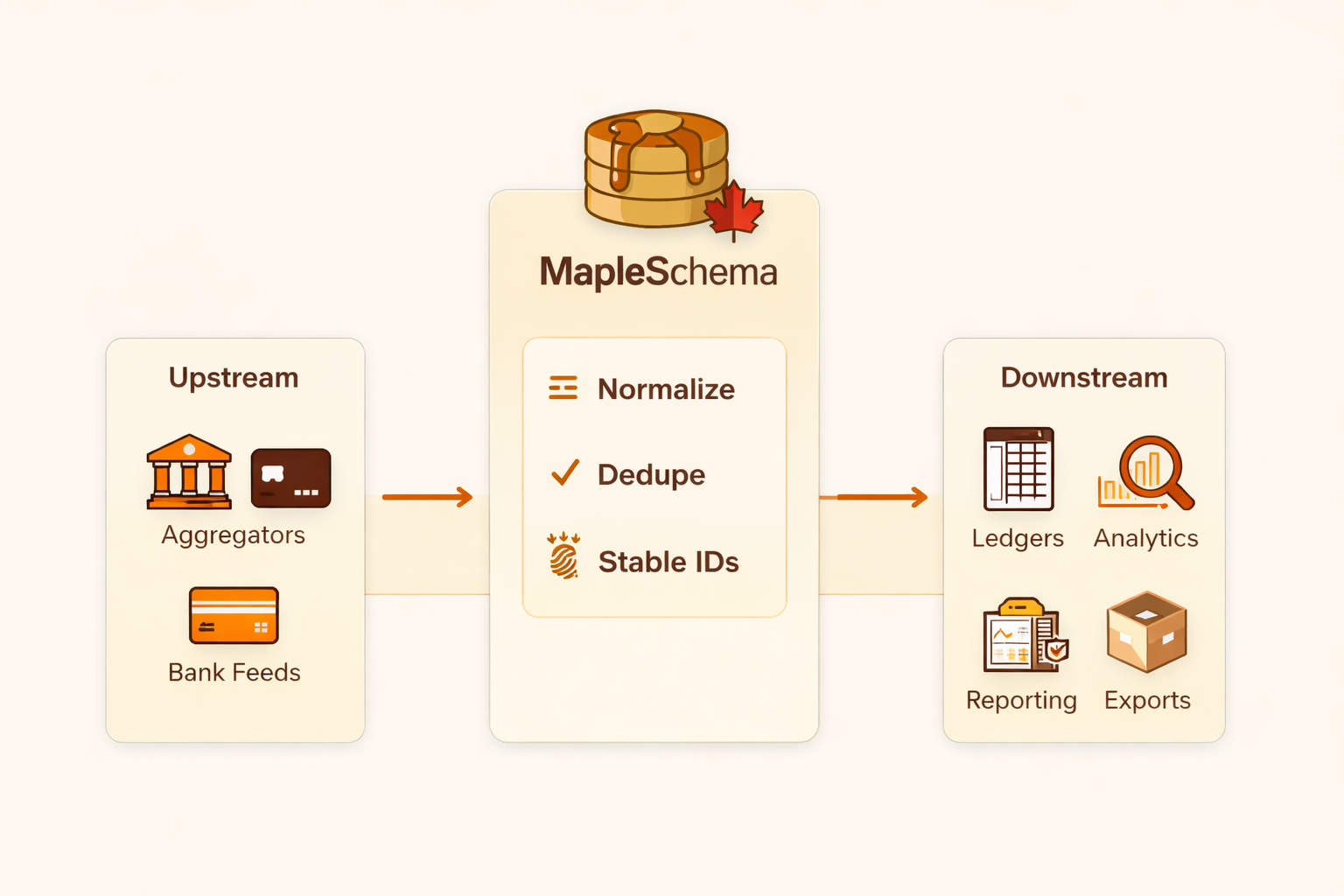

MapleSchema is a schema-first normalization layer for fintech platforms. It sits between upstream providers and downstream systems, so format changes don’t become rewrites.

Outputs are deterministic and include stable, anonymized, idempotent transaction IDs to prevent duplicates without exposing internal customer or account identifiers.

Licensed for internal use • Privacy-conscious processing • Deterministic outputs

Upstream: aggregators / bank feeds → MapleSchema: normalize, dedupe, stable IDs → Downstream: ledgers, analytics, reporting, exports.

MapleSchema does not replace your providers or analytics layer. It isolates upstream volatility from downstream systems.

Licensed for internal platform use. Not a consumer-facing service.

Normalize across aggregators and bank feeds into a stable contract your systems can rely on.

Predictable transformations, structured failures, and explainable outputs designed for operational use.

In-memory processing, minimal logging, and no reliance on internal customer identifiers for deduplication.

MapleSchema isolates upstream volatility from ledgers, analytics, reporting, and exports.

Avoid baking provider-specific fields into downstream systems. Normalize once, then move.

Built with common Canadian open-banking constraints in mind: data minimization, auditability, and residency.

Toggle between a representative upstream payload and the canonical contract your downstream systems can rely on. Optional insights.* fields are annotations only.